Finance automation includes a bevvy of technologies ready to transform how bankers do business, with robotic process automation topping the list. Banks and financial institutions are the highest adopters of RPA technology, commanding 29% of revenue share in 2020.

Robotic process automation deploys an army of apps and software to perform repetitive tasks. These bots are proficient in rule-based tasks, making them a prime candidate to take on tasks that take up a large chunk of staff hours. RPA helps shift the responsibility of formulaic data handling from human to machine, enabling back offices to run in a smooth, autonomous manner.

Instead of handpicking one-off processes to automate, banks are looking to bestow the benefits of automation onto every line of business. What makes intelligent automation in banking so compelling for the financial sector?

- Higher accuracy mitigates regulatory risks and reduces the likelihood of steep fines

- Reduces costs of maintaining compliance

- Boosts productivity by unyoking high-value workers from time-wasting data entry tasks

- Increases the speed at which banks can serve customers.

Banking back offices are not just overwhelmed by a high volume of complex data, but its handling requires high speeds and a precise degree of highly regulated accuracy. What are the four most popular use cases leading the charge towards wide scale adoption?

Improved CX driving most finance automation

Since the onset of COVID-19, ATM use and in-person visits to banking branches have declined by 5% and 12%, respectively. On the flipside, adoption of digital channels like mobile apps and calls to service centers and remote advisors has skyrocketed. The concept of banking has shifted from brick-and-mortar to clicks-and-bricks, where physical locations still stand for customers reliant on old school techniques while the bulk of transactions occur online.

Sluggish back-office processes delay the speed at which a bank can serve its digital customers. Financial institutions spend upwards of $500 million per year toiling with manual tasks like customer due diligence. Tech-savvy banks are turning to finance automation to flatten these administrative speed bumps so customers can open new accounts, refinance mortgages, and apply for loans at lightning speeds. What processes are they focusing on?

- Know-Your-Customer (KYC) Checks

- Verification of identity

- Prioritization and handling of incoming customer inquiries

The digital banking shift mandates banks to offer every step of the customer journey online, including the data-intensive KYC process. Allowing customers to simply check their balance or transfer between accounts no longer cuts it—customers expect to perform even the most complex, layered financial activities from home.

Increased regulatory compliance

When it comes to saving costs, regulatory compliance is not where you should cut corners. Slack compliance efforts are more than an operational headache, but cost banks an average of $86.1 million per violation. With so much at stake, banks are turning to the tools of automation to help maintain highly accurate, up-to-date records. What areas are the leading financial institutions automating?

- Preparing records for audits and other routine examinations

- Quality assurance initiatives

- Ongoing regulatory monitoring

Wherever organizations involve manual activity, they’re vulnerable to human error. Studies show that over 90% of spreadsheets contain errors, proving that even the most diligent banking professional can be guilty of an errant keystroke. Fines issued to banks could surpass $8.4 billion in 2021, so it’s critical that banks work towards end-to-end automation in regulatory divisions in order to avoid hefty bills.

Streamlining data processing with finance automation

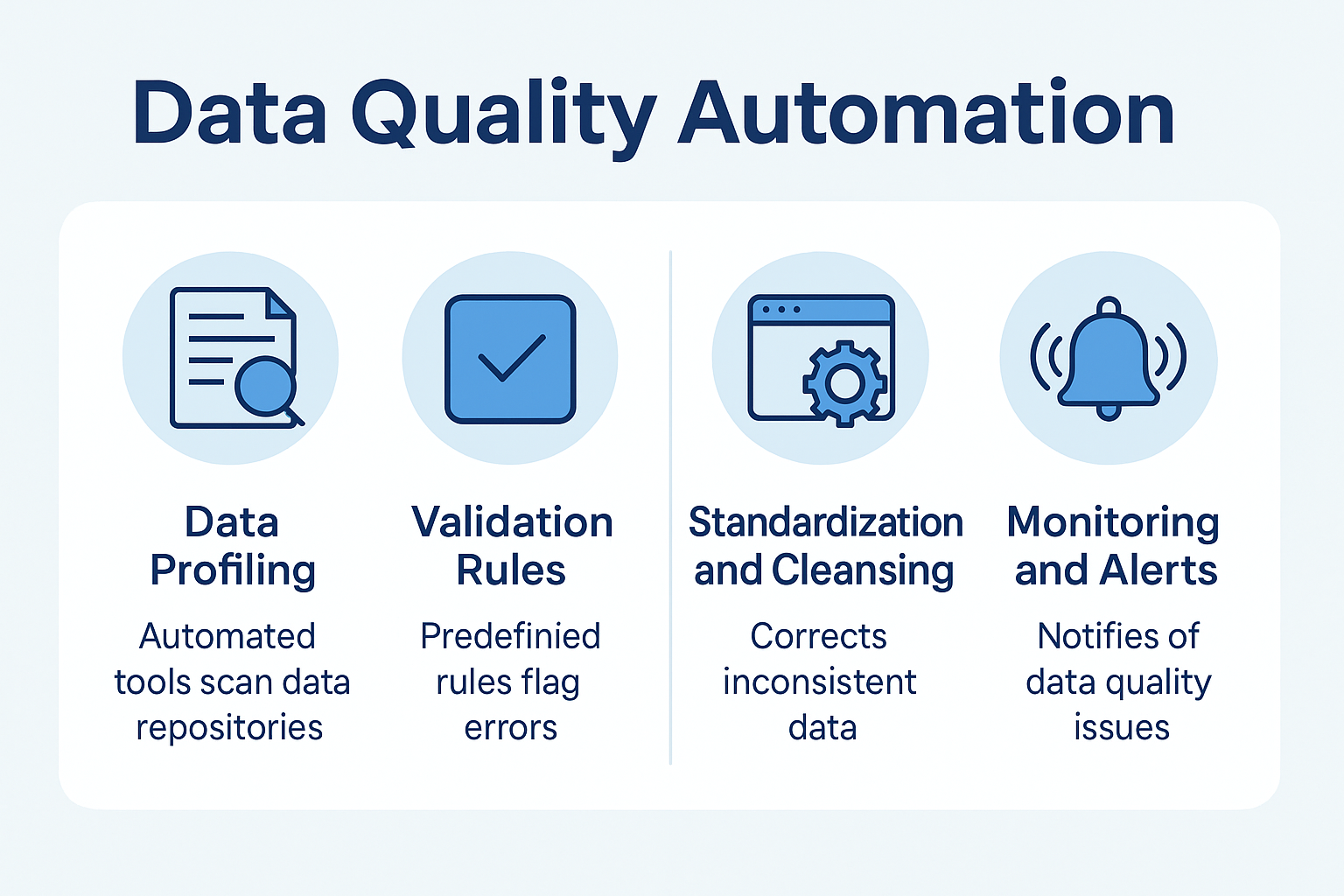

Manual data handling consumes staff hours across all industries. In fact, a recent survey illustrates just how many hours are lost per year—employees waste up to 78 days per year embroiled in rote administrative tasks. With the highly complex, heavy data haul shouldered by financial institutions, banking teams are even more vulnerable to these productivity-draining losses. To turn the tides on misspent time, banks are using RPA to transform:

- Data and verification checks

- Reconciliation processes

- Digitization of paper forms and applications

Shifting the responsibility of rule-based data processing over to apps and software frees up bandwidth for high-value knowledge workers. They can then focus on revenue-boosting projects like product upsells, building new campaigns based on big data, or improving financial products to better suit customer demands.

Faster financial products and services

Customers expect speed-of-light treatment from nearly every business they interact with. They’re no longer willing to wait days—or even hours—for processes to make their way through a convoluted banking back office. In fact, nearly three-quarters of customers believe banking services should be instantaneous, and 65% are ready to walk if a process drags on a moment too long.

Banks are using automation tools like RPA to satisfy these speed demands. They’re using automation to foster a more positive customer experience in:

- Loan applications and processing

- Enabling and disabling debit cards

- Financing domestic and international trade transactions

- Customer off-boarding

- Same-day transfers

Bots can self-extract data and populate templates in mere seconds—tasks that would take even the fastest typist several minutes to complete. By automating these key products and services, banks can serve up a suite of services that can quickly address customer needs.

Banks can no longer table intelligent automation initiatives in the back office. The cost of ignoring automated tools like RPA has far surpassed any excuse to wait. Harsh regulatory fines, lost customers, and squandered employee productivity are amongst the highest risks of delaying RPA adoption. By championing the benefits of automation in your bank now, you’ll join a powerful group of financial institutions seizing this red-hot opportunity.