Intelligent Document Processing (IDP)

Leverage ProcessMaker IDP and advanced OCR capabilities to turn unstructured data into actionable insights.

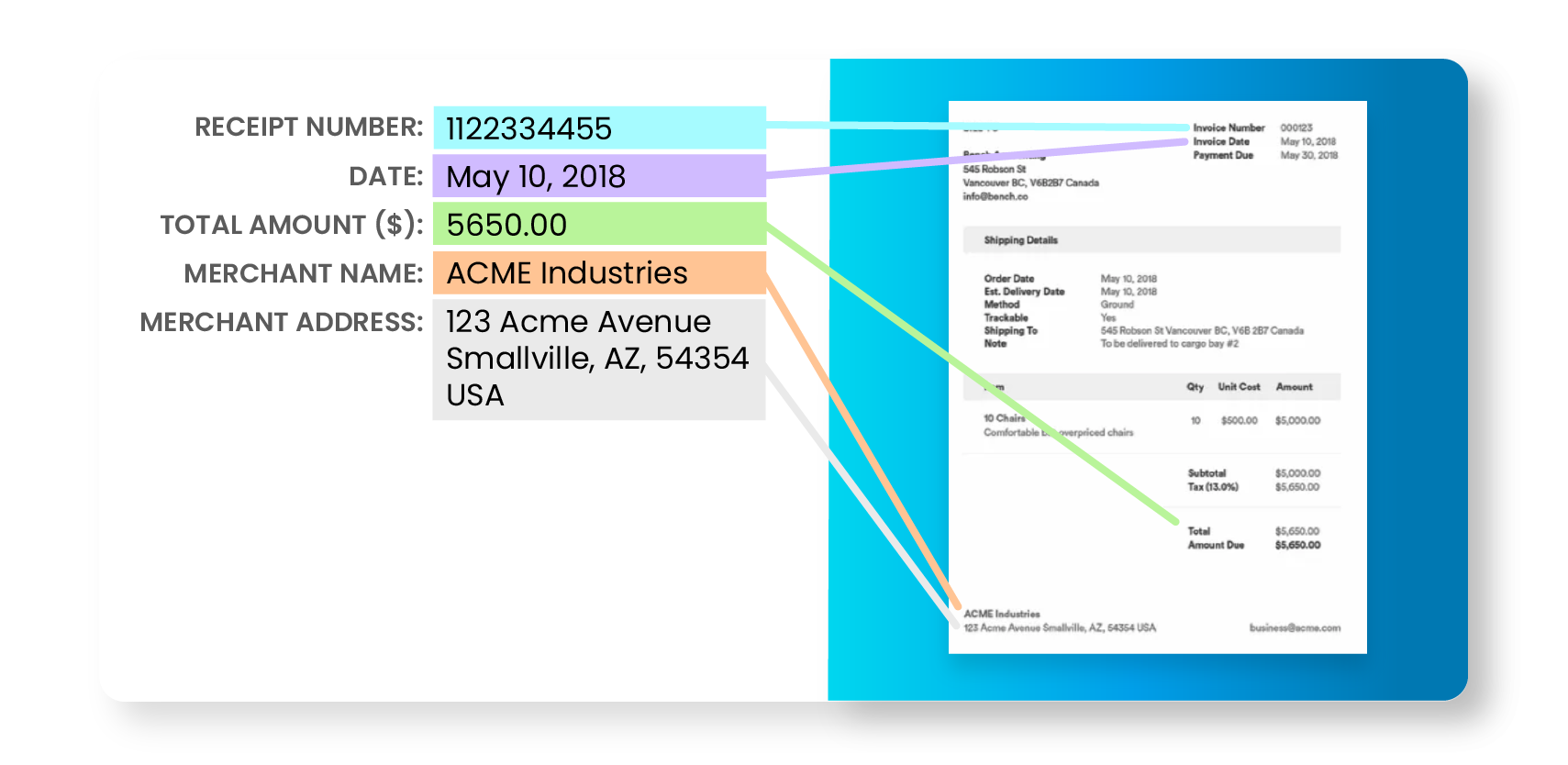

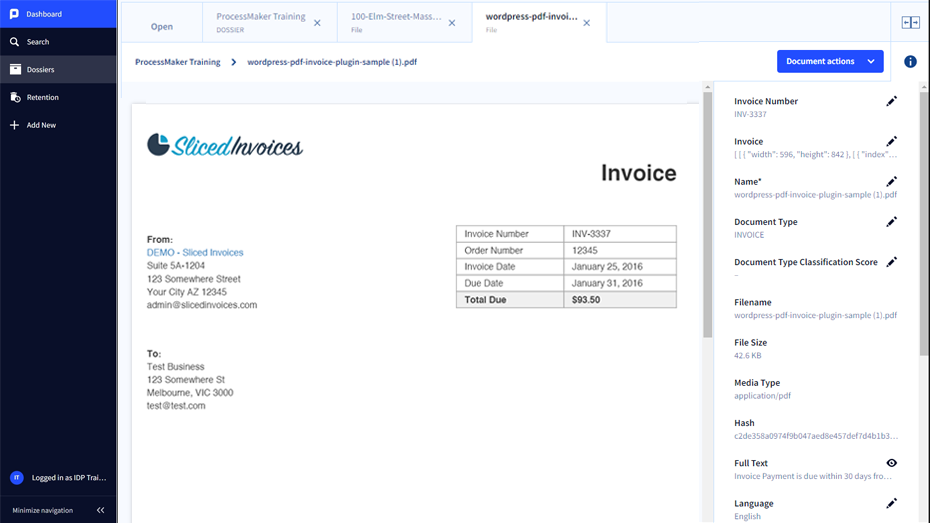

- Replace manual data entry with automated AI-driven extraction and classification to ensure data integrity by extracting key information from images and documents

- Initiate automated workflows in ProcessMaker Platform to manage exception handling

- Keep your skilled workforce focused on high-value activities, not repetitive data entry

- Train ProcessMaker IDP to understand documents unique to your process

- Replace manual data entry with automated AI-driven extraction and classification to ensure data integrity by extracting key information from images and documents

- Initiate automated workflows in ProcessMaker Platform to manage exception handling

- Keep your skilled workforce focused on high-value activities, not repetitive data entry

- Train ProcessMaker IDP to understand documents unique to your process

>80%

of business data

is unstructured

>80%

of manual data entry

can be automated

>1 Billion

documents processed by

ProcessMaker IDP to date

ProcessMaker IDP Critical Capabilities

Intelligent Document

Processing (IDP)

Unlock insights from unstructured data with intelligent OCR for data extraction & classification

Intelligent Process

Automation

Turn collected data into insights that trigger automated workflows via ProcessMaker Platforms’s direct IDP integrations.

Train Highly-Specialized

Data Models

Not all data models are available in the marketplace. Train exactly what you need with ProcessMaker IDP.

ProcessMaker IDP Features

Intelligent Document Processing (IDP) is a powerful software solution that utilizes AI technologies to capture, transform, and process data from various types of documents. It offers numerous benefits for businesses, enhancing efficiency, reducing costs, and enabling faster knowledge sharing.

Intelligent OCR & Computer Vision

ProcessMaker's Intelligent OCR doesn't just scan; it understands. With state-of-the-art technology, it guarantees up to 99% accuracy, ensuring that vital details from documents like contracts, tax IDs, and invoice amounts are accurately captured.

Extensive Document Handling

Over a billion documents, from semi-structured to completely unstructured formats like images, emails, and PDFs, can be seamlessly processed. This robustness ensures every piece of critical information is unlocked and put to use.

NLP & Data Enrichment

Natural Language Processing technology ensures data is extracted, understood, and enriched. This facilitates advanced functionalities like instant document search, typo corrections, and intelligent data analytics.

What Happens Next

Embrace simplicity in handling complex decisions with ProcessMaker’s BPA Platform. Our platform offers a flexible approach that manages multiple decision options outside the process flow. Use our intuitive process modeling and decision tables to easily view, understand, and represent business rules in your processes. Simplify decision-making, increase transparency, and optimize outcomes with ProcessMaker’s streamlined tools.

Start your automation journey right

UNLEASH AUTOMATION POTENTIAL

Enable end-to-end process automation with a platform giving you access to AI-powered Business Process Automation (BPA), Intelligent Documentation Automation (IDP), Decision Engine and API Integration.

Frequently Asked Questions

What is IDP (Intelligent Document Processing)?

What are the core benefits of your IDP solution?

How big of an impact can it have?

What type of documents can be processed?

Is it cloud-based?

Do we have to integrate it with ProcessMaker BPA? Can it run separately?

Will IDP reduce costs?

Learn more about

Intelligent Document Processing (IDP)

Request a Demo

Discover how leading organizations utilize ProcessMaker to streamline their operations through process automation.