To stay competitive in a saturated market, banks have had to explore emerging technologies to deliver the best customer experiences. From within, the challenges to maximize efficiency as cost-effectively as possible without sacrificing security are pressing as ever. To meet these demands, robotic process automation technology (RPA) has become a powerful and effective tool for banks to retain their competitive advantage in the race to digital transformation.

Today, we will dig into the nature of RPA, innovation in the banking sector, and how RPA can benefit banking tasks and functions to drive greater operational efficiency.

What is robotic process automation?

Commonly mistaken for artificial intelligence (AI), robotic process automation (RPA) is a rule-based software solution that automates repetitive tasks without any self-learning capabilities, (like machine learning, for instance). RPA vendors like UiPath and Automation Anywhere now offer AI capabilities as add-ons to their automation platforms. This includes RPA in banking where AI applications — like computer vision or Natural Language Processing (NLP) — is part of the automation process.

Most people have already had experience with RPA without knowing it. For example, automated private messages sometimes pop up on Facebook while a visitor is browsing a brand’s page. These messages are actually pre-programmed robots designed to answer questions in Messenger without involving human employees. RPA allows customers to get the answers they need more quickly while freeing up time for human employees. Now, humans can tackle more difficult problems more nuanced than a bot could handle, distributing the work and serving the customer as efficiently as possible.

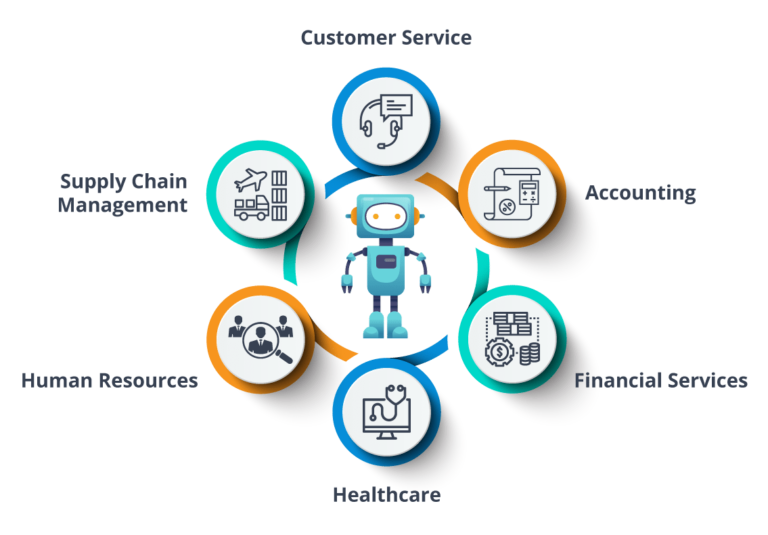

What parts of the bank can RPA automate?

In the finance world, this technology has the ability to digitize the front, middle, and back offices of banks. The front end is client-facing, sales and trading, investment banking, wealth management, and private equity — the real money-makers of the bank. The middle office is “the department in a financial services company, investment bank, or hedge fund that manages risk and calculates profits and losses,” according to Investopedia. The back office is behind-the-scenes operations like settlements, clearances, record maintenance, regulatory compliance, accounting, and IT services.

In banking use cases, RPA comes together with AI to create what is known as “intelligent automation.” It is through this intelligent automation that mundane, repetitive tasks can exist within the perks of AI’s predictability and more complex algorithms to achieve more in the bank than with RPA alone.

RPA spearheads banking digital transformation What parts of the bank can RPA automate?

In the banking industry, there are several repetitive tasks normally tended to by humans. According to Deloitte’s 2018 Automation in Onboarding and Ongoing Servicing of Commercial Banking Clients report, these are examples of how RPA is automating common banking tasks today:

- Opening emails and attachments

- Filling in forms

- Copy and pasting data, then merging data from multiple places

- Following “if/then” decisions and rules

- Extracting and reformatting data into reports or dashboards

- Moving files and folders, and extracting structured data from documents

- Connecting systems through APIs

- Reading and writing to databases

- Making calculations

- Scraping data from the web

- Logging into web/enterprise applications

These tasks are part of greater processes and procedures in finance. Functions like account management, lending, risk management, and compliance show the greatest promise for RPA’s automation potential.

For example, in compliance operations, employees might need to copy information from an internal document to compliance forms. For fraud, employees may need to sort through vast volumes of data in spreadsheets, extract specific data points, and generate an incident report. RPA has the potential to automate most of these processes.

For lending, let’s analyze a typical consumer loan process without RPA. Employees at banks might need to do highly repetitive manual tasks, such as copying and pasting information between emails, loan-processing systems, and several government websites. The process traditionally looks something like this:

- When the customer calls the bank, a customer service employee on-boards them into a loan processing system

- The consumer loan officers then perform a manual credit check. They then copy this data into other databases required for compliance or data storage purposes

- The information given by the customer, such as names and addresses, are cross-verified against government records on legitimate websites

This entire process is manual and needs to be done over and over again for each customer. With RPA, a loan officer receives the customer data at the click of a button. The RPA software could automatically perform the credit check, copy all the data to other databases and cross-verify the data against government records in real-time.

Finally, RPA has the power to streamline the customer onboarding experience. Banks can deploy RPA platforms to automate information transfer from the customer to the bank, and from the bank back to the customer. Nothing loses a customer at a bank faster than an inefficient customer experience. The ABA Banking Journal reports that customers are nearly three times more likely to churn during the first 90 days of opening an account. This is why delivering a seamless customer onboarding experience is paramount to retaining a competitive advantage in the increasingly volatile world of finance.

The benefits for banks using RPA

RPA has proven to reduce employee workload, costs, and lower the time it takes to complete manual tasks. Automation’s prevalence is rising in the finance industry, especially when paired with AI. According to Business Insider Intelligence’s AI in Banking report, implementation of AI in banks could account for $416 billion of the total potential AI-enabled cost cuts across industries.

There are several benefits to having RPA used in banks. Banks can expect to experience the following positive effects of implementing RPA successfully in their business models:

- Improvements in customer Service Level Agreements (SLAs)

- Increased operational agility

- Promotes customer trust and loyalty

- Increases revenue and cash flow

- Reduced processing time

- Reduced customer churn

- Improved customer experience

- Reduced business response time

- Improved regulatory compliance

RPA enables banks to complete back-end tasks more accurately and efficiently without overhauling existing operating systems.

Summary

Innovation is continuing to sweep the finance industry. This makes the market competitive and desperate for solutions that meet new customer demands. RPA has proven to digitize the manual tasks in core banking functions while increasing operational agility.

Is your bank considering an automated solution to aid in meeting the demands of today? ProcessMaker’s intelligent workflow platform specializes in automating workflows for banks just like yours. We also partner with Automation Anywhere to give you the benefits of RPA and business process management all in one platform. For more information, please visit our website at www.processmaker.com to book a demo today!

About ProcessMaker

ProcessMaker is a low-code business process management and workflow software. ProcessMaker makes it easy for business analysts to collaborate with IT to automate complex business processes connecting people and existing company systems. Headquartered in Durham, North Carolina in the United States, ProcessMaker has a partner network spread across 35 countries on five continents. Hundreds of commercial customers, including many Fortune 100 companies, rely on ProcessMaker to digitally transform their core business processes enabling faster decision making, improved compliance, and better performance.