Streamline commercial account opening at your bank

Our commercial account opening solution provides a platform that is intuitive, interactive, and user-friendly.

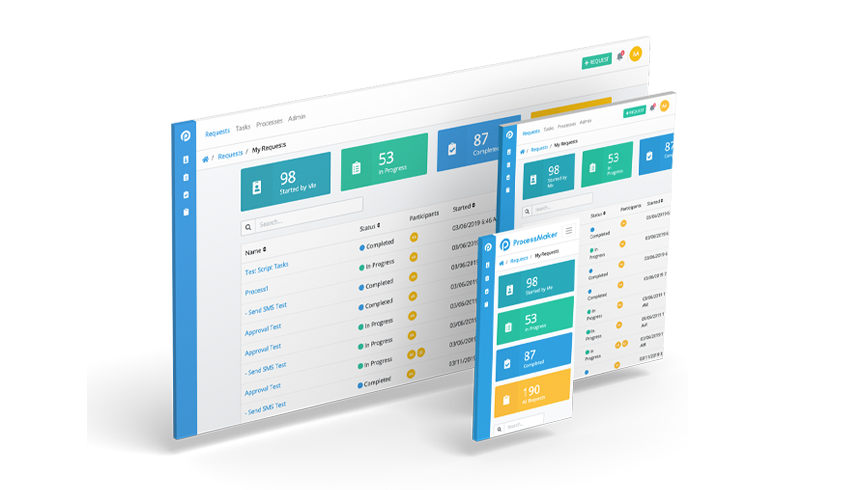

Results-based monitoring

Establish controlled, KPI-based processes and monitor performance using charts and dashboards. Banks can also ensure rules defined approvals and contextual communications. Our commercial account opening solution facilitates the creation of an interconnected account opening workflow while driving departmental coordination, communication, and information handling.

Reduce manual intervention and human error

Getting rid of manual interactions like de-dupe checking and customer verification which involves cumbersome process of cross-validating data from various disparate systems

Streamline Know Your Customer (KYC)

Our solution empowers banks to automate the entire commercial account opening process. It helps in meeting not only the regulatory compliances but also in leveraging the information received through KYC. Central KYC Registry(cKYC) is a centralized repository of KYC records of customers in the financial sector with uniform KYC norms which helps you conduct KYC due diligence digitally using KYC identifier.