We help you deliver simplicity in banking services

Design, automate and deliver an optimal experience to customers, accelerate and streamline lending, and automate and mitigate risk & compliance at your bank with our end-to-end banking automation platform.

Lending

Processing loans is becoming one of the greatest challenges for banks today. Accelerate loan volume and approvals while improving cross-channel loan efficiency from pre-qualifying to close.

Learn MoreAccount Management

Relationships come first. That’s why onboarding new customers with a seamless new account opening process is key. Prioritize how your customers feel from day one, and you’ll win their loyalty for a lifetime.

Learn MoreRisk & Compliance

Every day, banks are faced with illicit financial transactions such as money laundering, terrorist financing, and cyber crime. Adapt and build risk and compliance into your workflows.

Learn MoreAutomated Processes

A few of the commonly automated processes we streamline for our banking customers.

Account Opening

Individual Account Opening

Corporate Account Opening

Individual Credit/Debit Cards

Corporate Credit/Debit Cards

Risk Rating

Retail Loans

Commercial Loan Processing

Merge people, data, and processes all in one system

ProcessMaker enables you to sync stakeholders and each part of the transaction process in one easy-to-read overlay. Not only will you be able to see everything that is happening on the customer side, but you can also manage your bank’s need to be compliant at the same time. Automating these processes eliminates the possibility for human error during transactions.

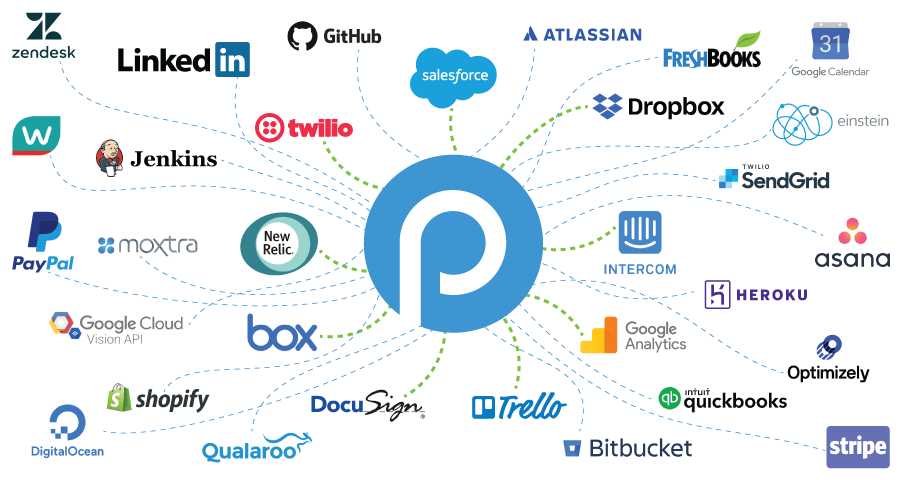

Easy integration with current systems

Our goal is to uplift your current systems to meet the demands of today. Our software integrates with most systems to enable: faster decision-making, easier communication between bank staff, increased accountability during screenings, rule changes, and other customer interactions. ProcessMaker makes your current suite compliant-ready and up-to-date.

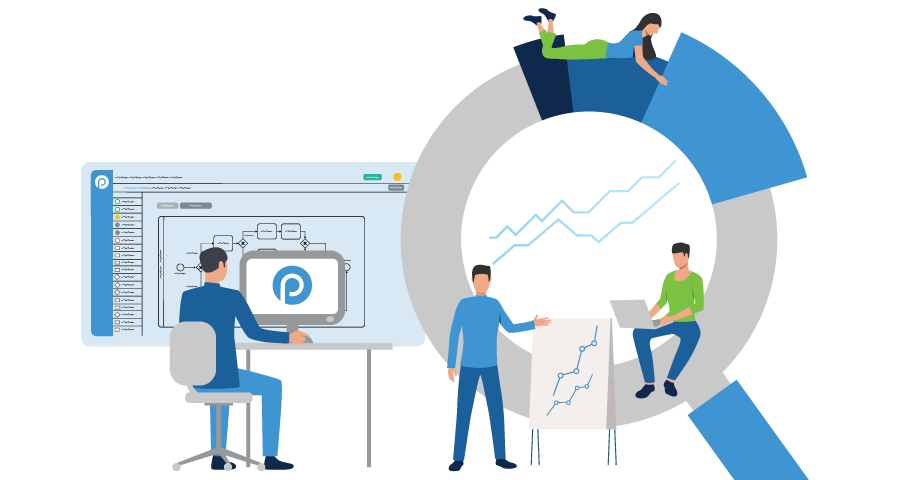

Improve reporting and audit trails

Since our software gathers, synthesizes, and applies data to replace manual methods, human error significantly drops. By integrating RPA and AI into the platform, data is analyzed and deployed from one digital source. You’ll never have to worry about paper documentation or miscommunication between stakeholders ever again.

Is your bank ready to process SBA / PPP Loans?

As PPP loan requests begin to flood in, it's time to make sure your bank is prepared for the new SBA 7(a) Paycheck Protection Program. Financial institutions hoping to help small businesses land some of the $349 billion in Small Business Administration (SBA) assistance from the federal coronavirus stimulus package need to take steps now to prepare for a wave of customers seeking relief.

See Video DemoAccess Bank Case Study

Access Bank, a publicly traded Nigerian multinational commercial bank, delivers sustainable economic growth that is profitable, environmentally responsible and socially relevant with ProcessMaker.

Learn MoreTrusted by banks worldwide